This post by Mike Haber is part of a series on Handling Money and Taxes. Mutual aid is rooted in community solidarity and movement organizing, but as activities grow in size and complexity, questions around tax and other legal issues can come up. In February 2021, Mike Haber and Dean Spade led a teach-in with BCRW addressing some of these issues (watch the video here). This series of posts on Big Door Brigade responds to specific questions people submitted after the webinar. Groups just starting to think about how to organize their mutual aid work may also want to check out this chart outlining some of the potential costs and benefits of different approaches to handling money in mutual aid groups.

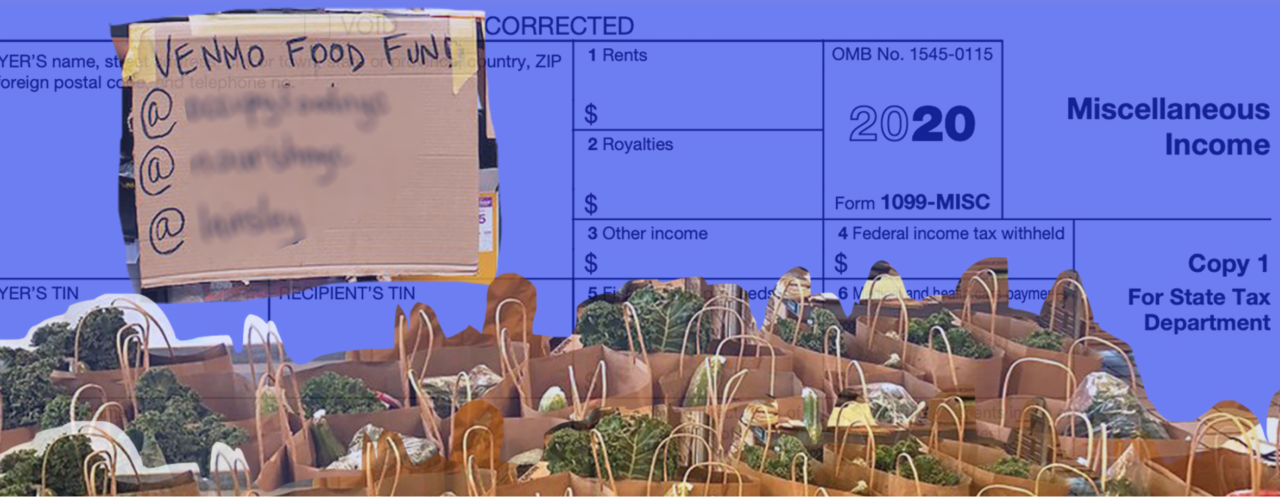

My mutual aid group used my Venmo account to ask for contributions online and I got a 1099-K form showing that all of that money that the group used was income to me. Do I have to pay taxes on that?

A lot of mutual aid groups and other movement organizations that receive money through one member’s payment platform account (Venmo, PayPal, CashApp, etc.) have been worrying about what to do if and when a member receives a 1099-K form showing money for the group as taxable income just for that one member.

Starting next year (the 2022 taxes due in April 2023 for most people), this issue will be even more common: legal changes made in the 2021 American Rescue Plan Act mean that a lot more people are going to be in this position. Last month, the IRS, through its Taxpayer Advocate Service, finally gave some initial advice on what the IRS expects someone to do who receives a 1099-K form that incorrectly lists money that should not be counted as income.

First of all, if you get a 1099-K form, you probably shouldn’t just ignore it: if you get the form (or even if you don’t, but it was sent to you by the platform at the address they have on file for you), the IRS also gets the form, and they will be expecting you to pay taxes on the money reported on it. Just ignoring it could mean an audit or worse.

But is that money actually income that should be taxed? Maybe not.

Under the Internal Revenue Code, all income, regardless of its source, is taxable unless there is an exception. One important exception is for gifts, which the Supreme Court has defined as things given with “detached and disinterested generosity . . . out of affection, respect, admiration, charity, or like impulses.” In short, the Supreme Court says, “the most critical consideration . . . is the transferor’s ‘intention’.” When people send money to you to support your mutual aid group with an intent that meets this standard, it should not be taxable income–but not all payment platforms do a great job of explaining this to people who give you money, and, even if they did, someone might make a mistake in what boxes they check off on a payment platform app.

What the IRS’s Taxpayer Advocate Service has made clear is that the IRS expects taxpayers to sort out any errors on their 1099-Ks with their payment platforms, and will not offer a way for taxpayers to try to tell their story to the IRS, saying that “mistakes may happen” and that if a gift is wrongly reported on a 1099-K, “you will have to contact the payment app company to request they send a correction to the IRS. This could be time consuming.” It is also a good idea to keep any records that show money given to you through your payment platform meets this gift standard in order to make your case to that platform.

For more details on this, I have a piece that lays out this legal analysis in a bit more detail, and gives some tips for groups first considering different platforms.